Renters Insurance in and around Albuquerque

Get renters insurance in Albuquerque

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- New Mexico

- Colorado

Protecting What You Own In Your Rental Home

It may feel like a lot to think through your busy schedule, keeping up with friends, family events, as well as deductibles and coverage options for renters insurance. State Farm offers hassle-free assistance and unbelievable coverage for your swing sets, souvenirs and electronics in your rented home. When the unexpected happens, State Farm can help.

Get renters insurance in Albuquerque

Coverage for what's yours, in your rented home

Why Renters In Albuquerque Choose State Farm

Renters insurance may seem like the least of your concerns, and you're wondering if you really need it. But pause for a minute to think about how much it would cost to replace all the possessions in your rented property. State Farm's Renters insurance can help when thefts or accidents damage your belongings.

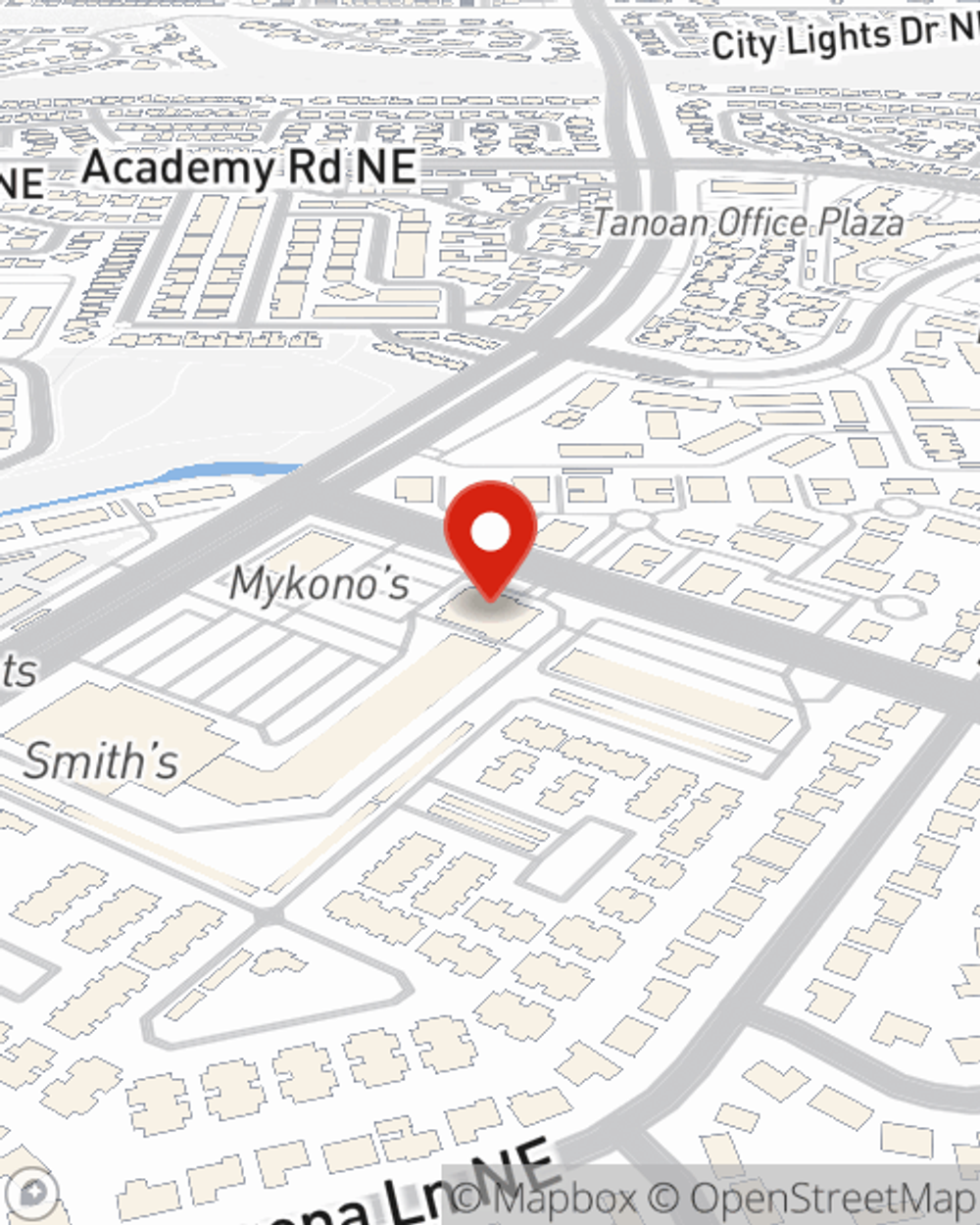

If you're looking for a dependable provider that can help you protect your belongings and save, reach out to State Farm agent Jesse Dompreh today.

Have More Questions About Renters Insurance?

Call Jesse at (505) 294-4422 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Jesse Dompreh

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.